Whether you're saving for retirement, your child's education, or a significant life event, having a trusted financial partner can make all the difference.

Read MoreFor many Kansas families, building smart financial habits begins early, long before paychecks and bills become a concern. That’s why more parents across our Kansas service area are turning to Frontier to open Youth Savings Accounts that grow with their children

Read MoreA car is more than just transportation—it’s part of your daily life. If your current Auto Loan isn't working in your favor, refinancing could be the solution to lower payments and free up room in your budget.

Read MoreIn today’s fast-paced world, convenience is essential—especially when it comes to managing finances. Our Online Banking offers a seamless way for Kansas residents to stay in control of their accounts, no matter where they are. From secure transactions to time-saving tools, our platform is designed to make banking easier and more efficient.

Read MoreFrontier is here to help you make the most of your hard-earned money. Certificates of Deposit are a great savings tool that can help you grow your money at a guaranteed rate.

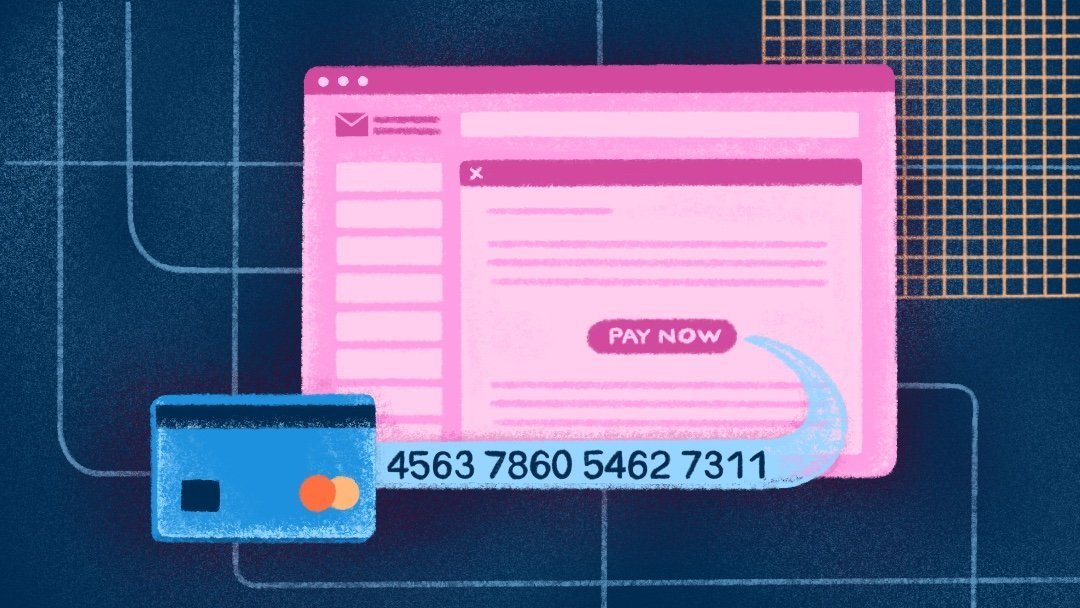

Read MoreCon artists cheat Americans out of billions of dollars every year. Recognizing red flags for potential scams can help protect you, your loved ones, and your hard earned cash.

Read MoreHelping teens start their financial journey is an essential step toward their independence. A Youth Credit Card in Kansas provides a structured way for young members to learn about responsible credit use while offering valuable benefits like no annual fees, no balance transfer fees, and rewards points.

Read More